Industrial OEM manufacturers are increasingly making investments in technology to improve their customer experience, communication, marketing, and their ability to serve customers. This consolidated set of technology is focused on aftermarket, service, sales, marketing, and customer support – and can be collectively known as “AfterMarTech” – combining all the aspects of dealing with existing customers (i.e., Aftermarket) with “Marketing Technology” (or MarTech) – the term used by Marketers to describe the tech stack used to optimize the customer experience. In the equipment manufacturing industry, this has been driven by leaders within individual functions, leading to a variety of different tools used by different teams that are disconnected, cannot share data, and are unable to complement each other. For many organizations, this is now a challenge – too many applications, no single source of truth, overlapping or redundant functionality, and high cost. Hence, many organizations are looking to consolidate their “AfterMarTech” investments to achieve process efficiency, cost optimization, and most importantly, improve their customer experience – with a big focus on existing customers and the Installed Base. For OEMs who want to lead their verticals moving forward, Aftermarket is no longer defined as just fulfilling replacement parts orders – Aftermarket is the broader set of services, parts, and solutions that enable the end-users to drive maximum value from their relationship with an OEM and establish the foundation to build a true partnership that is highly beneficial for the OEM

So, what is AfterMarTech?

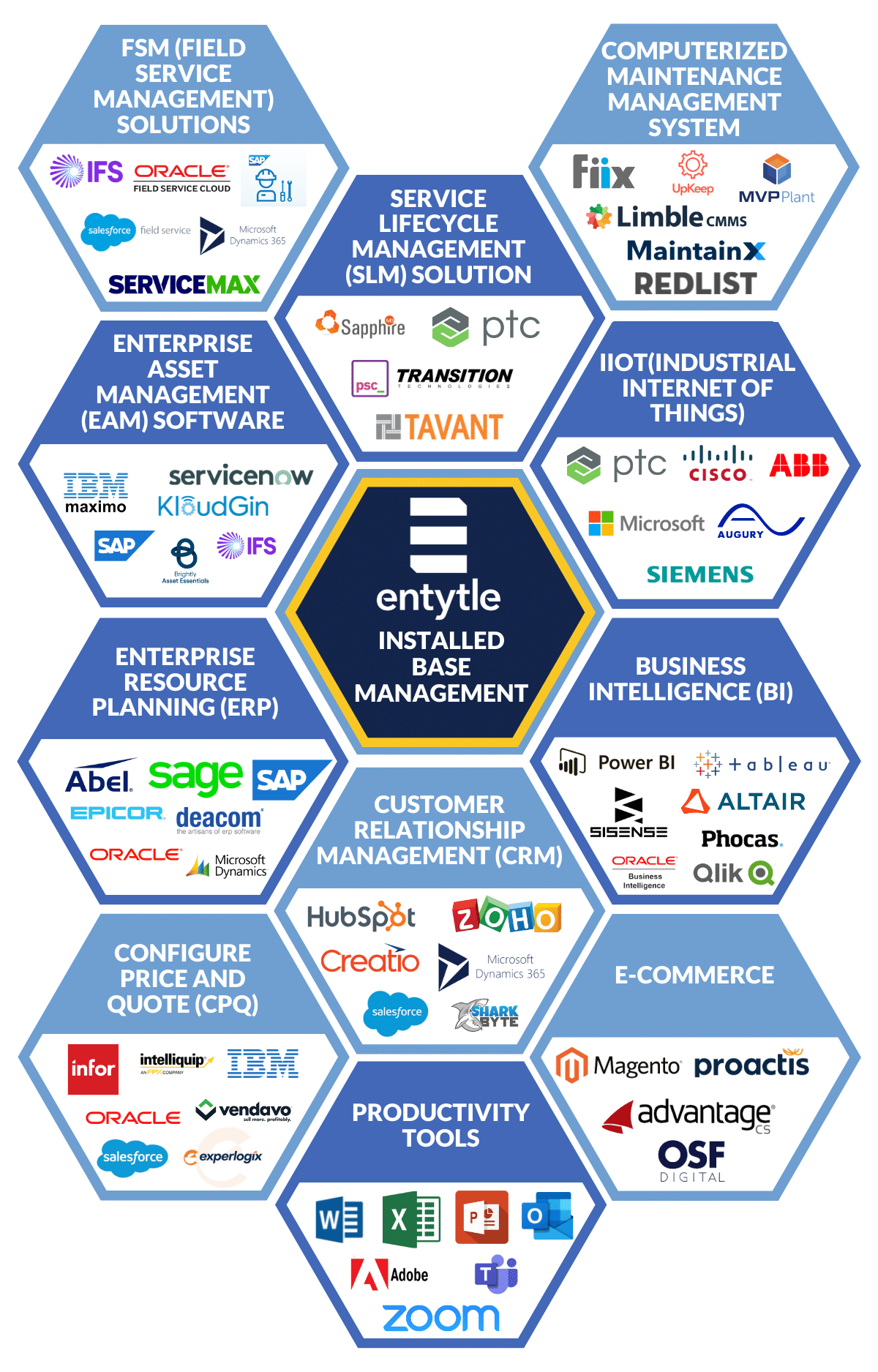

AfterMarTech is the set of technology (tools, applications, and workflows) that customer-facing teams, within manufacturing companies, need to optimize the customer experience. It often includes Customer Relationship Management (CRMC, Business Intelligence (BI), Digital Marketing, Field Service (FSM), and eCommerce, among others.

Why is AfterMarTech gaining traction?

Industrial Aftermarket & Service teams pull data from a wide variety of sources such as ERPs, CRMs, Data Warehouses, Warranty systems, Service systems, and of course spreadsheets. These tools typically do not talk to each other, and worse, duplicate records. Data extracts are then taken from different tools and are manually joined together a cleaned for use in a specific tool or workflow.

This delicate web of data queries, extracts, joins and clean-up scripts are held together by logic and custom programming that is deployed once, and then has to be maintained for years. This web remains unchanged for fear of disturbing a working environment but gets more and more complicated as new use cases and workflows are addressed. Eventually, it falls into disrepair or just breaks – and becomes the bottleneck for digital transformation and performance improvement. Some forward-looking OEMs attempt to replace these legacy workflows with newer ones – leading to the same rinse-repeat cycle of custom solutions, which are under-supported, get relegated to the tools graveyard eventually to be replaced by a new shiny patchwork that promises to solve the problem once and for all. Currently, this wave of digital transformation is underway across the industry with many OEMs focused on upgrading their ERP and/or CRM, or perhaps implementing a data warehouse and new BI tool.

Unfortunately, through this entire process, Aftermarket, Service, & Support teams suffer.

Traditionally Aftermarket is considered the step-child of OEMs when compared to new equipment sales teams. So they receive tools that they have to retrofit and work around to get their work done. This entire situation leads to broken workflows – often a hybrid of people and tools cobbled together.

What should take a few minutes for a customer-facing team, takes days or weeks? An example is an aftermarket leader trying to execute a campaign to drive sales for a new product upgrade. This starts with pulling together a report of a specific asset that can be upgraded with a new part. BI tools fail here as they are operating on poor-quality Installed Base data or do not have a full 360 view. CRMs are at best recording keeping tools – and while they promise a full ‘customer 360’, they fall short for OEMs who need to leverage the bill of materials, part number supersession, data from the last 30 years of legacy systems, and complex analysis of the transaction history including the inevitable ambiguity around what transaction is associated with each specific asset serial number. The ERP is also sometimes envisioned to solve this but is a mammoth that is suited to drive the materials, procurement, and financial workflows that depend on it – and is often so customized that it requires years and countless approvals from governance teams to do anything new. Adding a few legacy tools to the mix makes it almost impossible for the aftermarket leader to do their end job – upgrade those assets in the field.

These challenges have led modern, digital-focused OEMs to adopt a business-objective first approach with their technology strategy. They are laser-focused on driving very specific business outcomes, while also ensuring a sustainable technology investment model. They shy away from stand-alone tools and recognize that data quality and unification need to be part of the solution. They also understand that generic, horizontal platforms, while they can solve many workflows, often require a massive amount of customization (and then maintenance & sustainment) to truly solve the data-driven aspects of OEM workflows that are critical to driving a true transformation.

Wait a minute, how is AfterMarTech different from the tools Industrials already use?

AfterMarTech is different from the tools that Industrials use in significant ways –

- A change in thought process: Tools are not procured because OEMs need to invest in a particular category. The AfterMarTech thought process places heavy emphasis on business-centric justification leading to repurposing existing tools or investing in new ones with specific timelines, ROI, and deliverables in mind.

- Aftermarket & Service teams are not an afterthought: The AfterMarTech tool stack is designed for customer-facing teams from the ground up. It’s not just a patchwork of hand-me-downs from other teams that these teams have to put up with.

- Emphasis on data as a foundation for every insight & action: The AfterMarTech stack places an immense amount of emphasis on data quality to ensure that the tools that run on top of that data produce the desired outcomes. An Installed Base Platform is key to the AfterMarTech stack to ensure reliability and scalability.

- Business-case first: The AfterMarTech stack is designed with a specific business case in mind. Examples could be an Aftermarket team trying to move Slow Moving Inventory, or a Service team tasked with upselling parts during service.

What does the AfterMarTech Stack look like?

1. ERP:

ERP(enterprise resource planning) is a solution that integrates supply chain, operations, financials, commerce, reporting, manufacturing, and human resource-related processes.

Some well-known solutions:

2. CRM:

CRM(Customer relationship management) is a management solution that helps businesses to stay connected to customers, and internal stakeholders, as well as improve profitability.

Major providers include:

3. FSM:

FSM(Field Service Management) solutions are used and employed by OEMs or manufacturers who need to manage the installation, service, or repairs of machinery, systems, and equipment. Field service management mainly involves dispatching repair persons to an Installed Base location for maintenance or repair of equipment, systems, or assets.

Current Market players:

4. Business Intelligence:

Business intelligence (BI) solutions perform the tasks of retrieving, analyzing, and reporting industrial data for making informed business decisions. Their key features are the integration of multiple data, AI-driven data preparation, analysis, reporting, and interactive data visualization.

Some famous solutions:

5. Productivity tools:

Applications or Solutions used for producing, editing, recording, and showcasing information/data for an activity related to a specific task or activity. Tools such as spreadsheets, presentations, and documents are commonly used productivity tools.

Some famous tools:

6. IIOT:

IIoT(Industrial Internet of Things) System consists of Smart or Intelligent devices which are used to enhance the performance of machinery or equipment. IIoT system employs systematic communication infrastructure and uses data between them for the most optimum output or results.

Some Major players:

7. E-commerce:

eCommerce was one of the highest priorities for industrial manufacturers in 2022 according to our survey. You can check other priorities here. An eCommerce platform is an end-to-end software that helps retailers to manage their business online.

Essentially, the end-user should be able to use an e-commerce platform to discover products, shop around using a basket and then check out.

Some decent solutions

-

- OSF Digital

- Adobe Magento

- Advantage CS

- Proactis

8. Configure Price and Quote:

CPQ is a business development tool for businesses to quickly and accurately generate quotes for orders. CPQ can help sellers with an automatic, step-driven process that untangles and streamline the creation of complex customer quotes.

Top CPQ Solutions providers

9. Service Lifecycle Management (SLM) solution:

Service Lifecycle Management (SLM) is a process for managing the complete lifecycle of services within an organization. An SLM solution is a tool or software platform that helps organizations to manage the various stages of the service lifecycle, including service catalog management, service level agreement (SLA) management, incident management, problem management, and change management.

10. Computerized Maintenance Management System

A Computerized Maintenance Management System (CMMS) is a software platform that helps organizations to manage and optimize their maintenance operations. It typically includes features such as work order management, asset management, inventory management, and preventive maintenance scheduling.

11. Enterprise Asset Management (EAM) Software

Enterprise Asset Management (EAM) software is a tool that helps organizations to manage and optimize their physical assets. It typically includes features such as asset tracking, maintenance management, and asset performance monitoring.

12. Installed Base Management:

Installed Base management empowers the representation of objects installed at your customer’s site (such as machines, equipment, and so on) for which a service is offered. In other words Installed Base management is about managing the complete life cycle of the customer assets(ex. Industrial Machinery or equipment) from the time it is installed and becomes operational, through the period it is in use until the period till eventually it is dismantled.

Solutions provider for Installed Base Management:

- Entytle, Inc. provides an Installed Base Platform that assembles, cleanses, analyzes, and operationalizes Installed Base data so machinery manufacturers can make customer-facing workflows more efficient.

www.entytle.com

What are the key components of an AfterMarTech Stack?

- Installed Base Data Quality

- Installed Base Analytics/Insights

- Installed Base Workflows/Applications

1. Installed Base Data Quality:

Your Installed Base Data Quality determines the success of your aftermarket initiatives. The completeness, accuracy, and reliability of the Installed Base Data is the key component of any AfterMarTech Stack. Having a good hold on their Installed Base data creates exponential revenue generation opportunities for manufacturers. An Industrial Data Quality Engine will help you clean, connect and enrich your Installed Base data; keeping your data quality in check.

2. Installed Base Analytics/Insights:

Installed Base Analytics provides valuable insights from the Installed Base data that can be used to drive aftermarket and services revenue growth. Installed Base analytics can be used to spot patterns and trends in the Installed Base data, as well as any potential issues or areas that need improvement. With the help of Installed Base Analytics, organizations can make informed decisions about how to optimize their Installed Base data to make the most out of their Installed Base.

3. Installed Base Workflows/Applications:

Installed Base Workflows/Applications are important for your AfterMarTech Stack as they can help to streamline and automate many of the tasks involved in managing and supporting your Installed Base which improves your operational efficiency. Installed Base workflows also help you to tend to your customer needs faster leading to better reliability, performance, and customer satisfaction.

Entytle’s Installed Base Platform provides these key components of an AfterMarTech stack and is used by some of the world’s leading OEMs.

If you are an OEM/Industrial interested to understand how we can help you, Contact us.

How does an AfterMarTech Stack enable customer-facing teams?

- Segment Customers ie. Installed Base – Segment your customers based on your needs

- Prevent Drifting Customers – Identify and prevent drifting customers to reduce the churn

- Predict Opportunities – Predict opportunities from historical purchase patterns

- Create Targeted Hunting Lists – Powerful filters & ‘Index Search’ so you can create targeted hunting lists based on territory, model, product lines, etc.

- Track Competitive Equipment – Easily add competitive information and generate recommendations

- Drive Aftermarket/Sales Operations – Accelerate your aftermarket and Service growth with proactive selling

- Enable Channel Partners – Create targeted campaigns and territory-based plans for channel partners

- Identify Customer Loyalty – Calculate Customer Loyalty and Create granular campaigns and pipelines based on loyalty levels

- Parts Purchase Intelligence i.e. Rule-Based Purchase Rate Algorithms – predict what, how much and how often your customers will buy

- Calculate Wallet Share – Calculate wallet share gaps within your Installed Base

- Aftermarket Intelligent Kits ie. Order Basket analysis – Predict your customers buying needs to increase the overall order amount

- Slow Moving Obsolete Inventory Management