From Deal Thesis to EBITDA Reality: Why PE-Backed OEMs Must Fix Their Aftermarket Execution

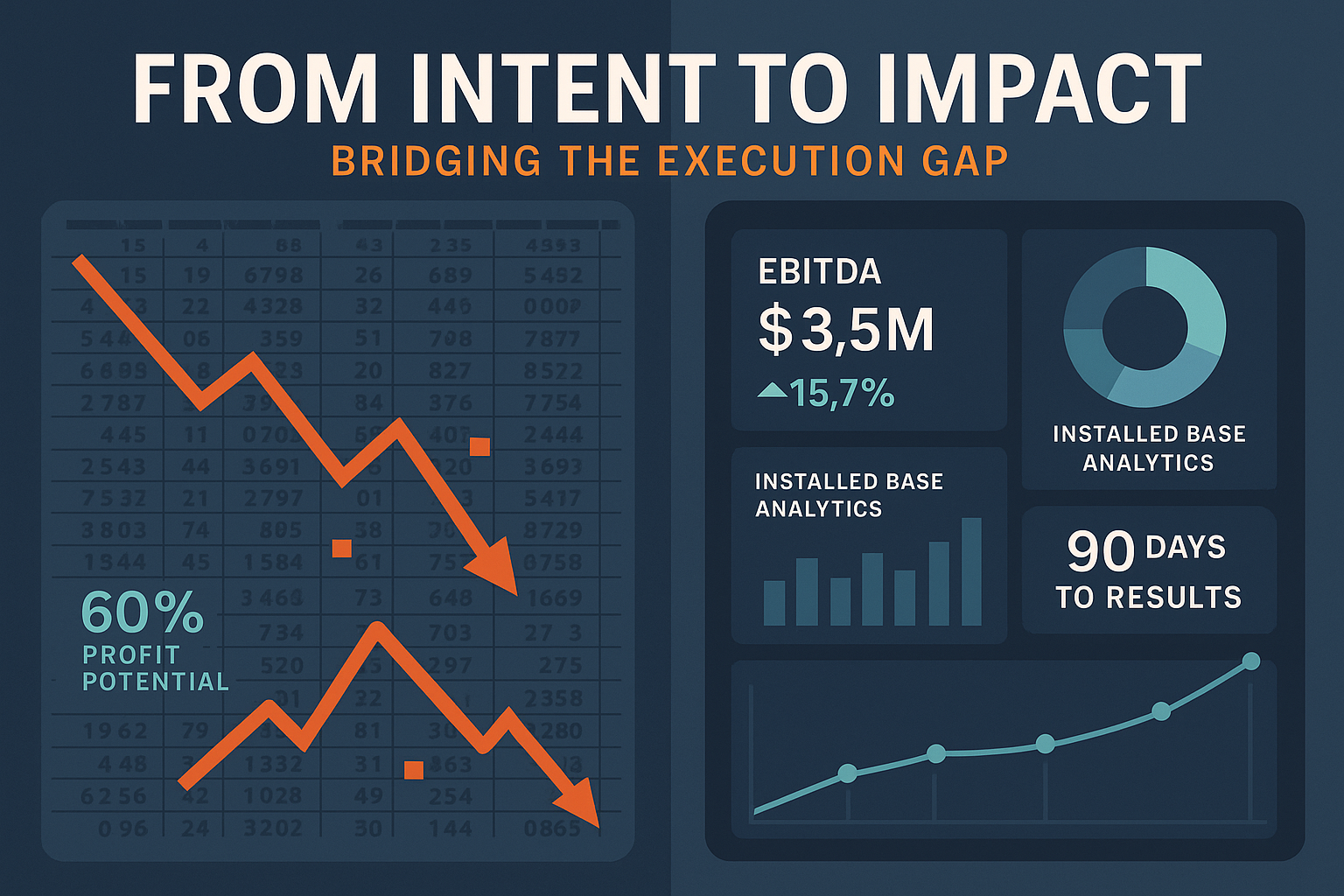

When private equity firms acquire industrial OEMs, the investment thesis looks bulletproof: unlock recurring revenue from the installed base, expand aftermarket margins, and drive sustainable EBITDA growth. It’s compelling on paper. Six months post-close, though, operating partners face a different story—the aftermarket engine promised during diligence is still idling in neutral. The gap between deal […]