The statistics are loud and clear – it’s much easier to retain existing customers than to bring on board new ones. Given the overwhelming evidence in this regard and the fact that most industrial OEMs have a mix of direct and indirect sales channels, it is vitally important that OEMs have visibility into their installed base and equip their channel partners with the same capabilities such that they can be effective at serving, and thus retaining, the OEM’s current customers.

Channel partners are extended arms of Industrial OEMs

Channel partners are extended arms of Industrial OEMs. They help them get their foot in the door in unexplored and unserved areas or as their only go-to-market strategy. Channel partners not only help sell and service but can help OEMs get feedback about their products and what customers are thinking and looking forward to. If channel partners themselves are not aware of their installed base, this could lead to missed opportunities to build a strong, long-term, and profitable relationship with customers. Think of a chain with the OEM at one end and customers at the other. Channel partners are the bridge. Consequently, channel partners play a very important role in being the eyes and ears for the OEMs on the ground.

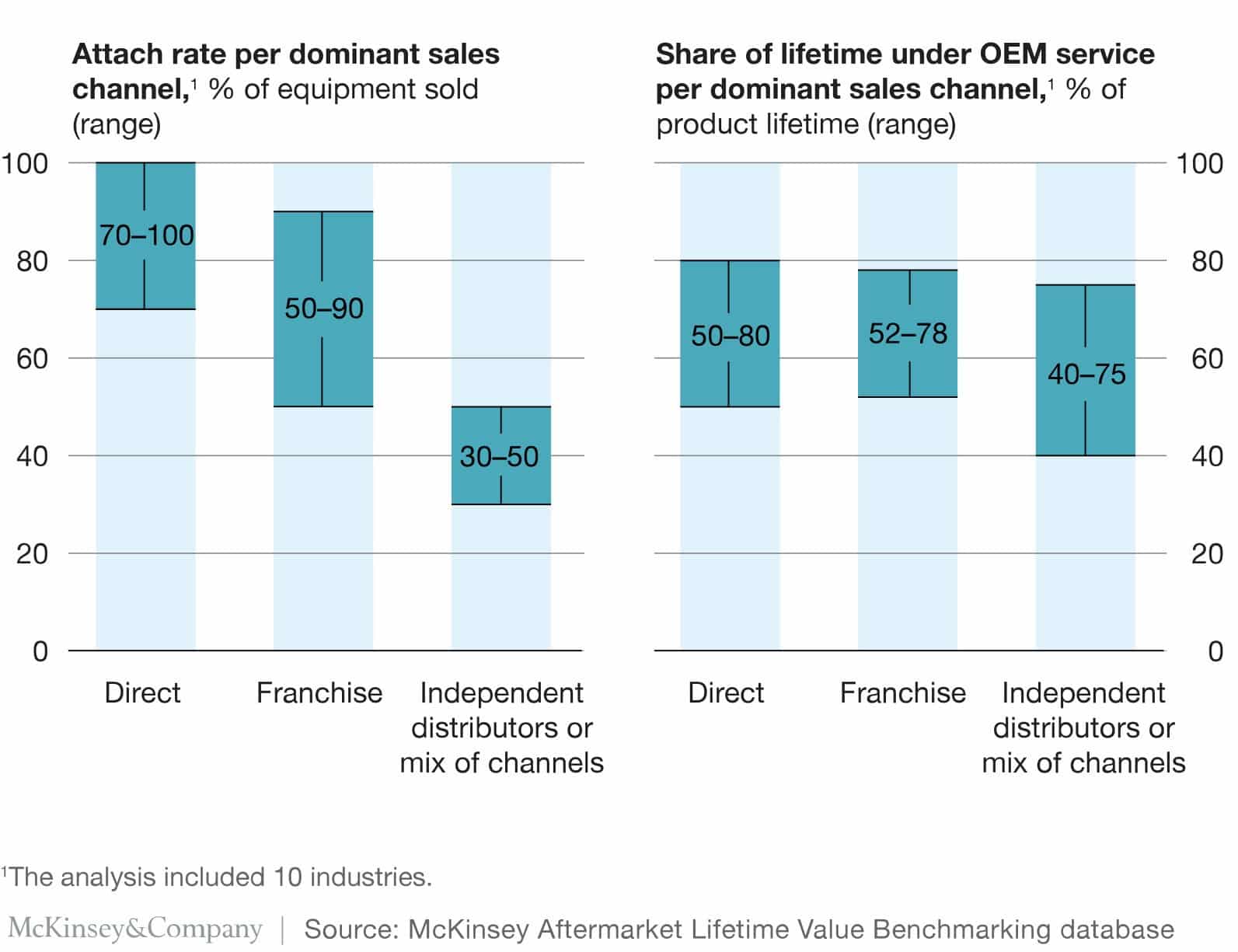

Exhibit 1: Strong channel control significantly increases attach rate and share of lifetime

Credit for Exhibit 1: Aditya Ambadipudi, Alexander Brotschi, Markus Forsgren, Florent Kervazo, Hugues Lavandier, and James Xing (2017). Source: Article – Industrial aftermarket services: Growing the core

In the rapidly-changing industrial landscape, channel partners can no longer just be resellers. They need to add value to their end customers. To be able to do that, they need to have complete visibility into what equipment their customers have and what their future requirements are. This is where industrial OEMs can make a difference because most channel partners are not equipped to do this. While the old way of spreadsheets and experienced sales reps tracking customers in their heads worked fine, is it scalable? The short answer is no and the consequences are missed opportunities to better serve customers and for upsell, cross-sell, and lucrative aftermarket sales.

“Channel partners can no longer just be resellers. They need to add value to their end customers”

Historically, channel partners have focussed on selling new products and services. A digital investment has never been on their priority list – mostly due to affordability reasons. Given the nature of the business, can the machinery manufacturers expect any single channel partner to make the digital investments to manage the installed base and then expect other partners in the ecosystem to utilize it? Likely the investment is too large for an individual channel partner and it also presents issues where partners will be reluctant to share data across the ecosystem. The equation changes when industrial manufacturers take the initiative. They can build a platform and bring on board all their channel partners. It’s a game-changer with great benefits for everyone involved, more so for the OEM.

OEM’s margins on the aftermarket side have generally been higher than on the sale of the new equipment. In addition, data indicate that customers who come to the OEMs for all their aftermarket requirements will likely upgrade or buy new equipment again with the same OEM. If OEMs are not engaged with the customer, the risk of a competitor entering the space and fulfilling the customer’s future requirements is a real threat that needs to be thoroughly addressed. And this is where an Installed Base Platform (IBP) comes into the picture.

Installed Base Platform is a system that collects, organizes, and unifies data from multiple data sources giving OEMs visibility into their installed base and helping them deliver the best experience to their customers. With an IBP in place, OEMs can strengthen their relationship with their channel partners and also through to the end customer.

Watch this 2-minute video to see why manufacturers need an Installed Base Platform

For the relationship between the (industrial OEM) manufacturer and the channel partners to strengthen, they must be willing to trust each other and share the appropriate information at the right time. This is a process that will evolve and develop over time, but to start off with one can start sharing customer information and their transactions however far back it is available. Depending on the relationship and competitive dynamics, pricing and/or cost data can be controlled or not shared at all, and of course, data needs to be restricted based on the role/organization.

Installed Base Platform can help drive installed base revenue – including parts/service, warranty extensions, service contracts, upgrades/mods, predicted parts, etc. IBP can also help drive productivity for sales and service – who is nearby, who has the highest propensity to buy, etc. Account management, which has often been limited to the top 20-30 accounts, can now take place for many more accounts with AI alerting to loyalty or slipping wallet share issues.

IBP can also help the business on issues beyond sales to IB. i.e., forecasting, addressing markets, field intelligence, marketing campaigns, etc. Channel partners have generally not invested in forecasting or marketing tools and so the introduction of IBP could help them plan for their future growth.

“Industrial OEMs typically work with multiple partners and now visibility via the Installed Base Platform helps figure out the ground realities.”

An Installed Base Platform can help with market resource planning, market assessment, etc. This helps enrich and grow the partner ecosystem. Channel partners have not been good at tracking their leads and an IBP solution can really help them in this aspect. OEMs typically work with multiple partners and now visibility via the IBP helps figure out the ground realities. OEMs can also now use this to plan their rebates, discounts, incentives, etc. thus covering the entire length of the value chain.

IBP is becoming an essential part of growing OEM’s businesses, especially on the aftermarket side. Given that, partners have lagged behind in keeping track of their ever-growing transactional data and not leveraging the latent opportunities in these, provides an opening for OEMs to step in and help their partners and customers in their next growth phase. Not only will it strengthen the relationship with their partner and customers but importantly help both reap the benefits. When one thinks of all these benefits, the case for an IBP only becomes stronger.