What Is the Executive Visibility Gap in Manufacturing?

Most industrial OEMs have real-time visibility into their sales pipeline—but almost none into their installed base. This “Executive Visibility Gap” has become one of the most overlooked challenges in modern manufacturing.

Leaders can track every opportunity, forecast, and quarterly target, yet remain blind to what’s happening across their most profitable revenue engine—the equipment already deployed at customer sites. According to industry research, nearly 70% of OEM data remains buried in fragmented ERPs, legacy databases, and spreadsheets, making it invisible to the executives who need it most.

This isn’t a sales issue—it’s an enterprise intelligence problem. Without installed base visibility, OEMs lose millions in aftermarket revenue, miss renewal opportunities, and make strategic decisions based on partial information. In short, leaders are flying blind across the most valuable part of their business.

Why Industrial Data Silos Keep OEM Leaders Blind

The root cause of the executive visibility gap lies in how industrial OEMs have evolved their technology infrastructure. Over decades of growth — through organic expansion, acquisitions, and geographic diversification — these organizations have accumulated a patchwork of disconnected systems that were never designed to communicate with each other.

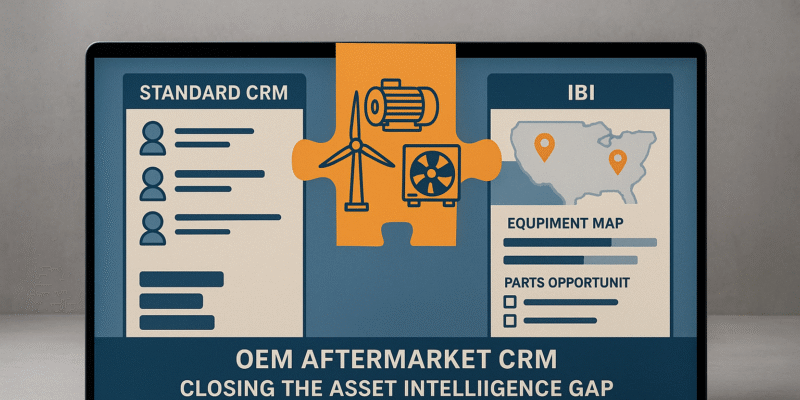

Enterprise Resource Planning (ERP) systems house transactional data about what was sold and when. Customer Relationship Management (CRM) platforms track opportunities and touchpoints. Service management systems log maintenance events and warranty claims. Field service applications capture technician notes and installation details. Each system operates in its own silo, using different data models, inconsistent naming conventions, and incompatible formats.

The result? Fragmented ERP data that makes comprehensive customer and asset analysis nearly impossible at the enterprise level.

Consider a real-world scenario that plays out in executive meetings across the industrial sector: A CEO asks their team, “What’s our total exposure with this Fortune 500 customer across all business units?” It’s a straightforward question with profound strategic implications. Yet the response typically involves days of manual data gathering, spreadsheet consolidation, and educated guesswork. Different business units report different customer names using various abbreviations, legal entities, and informal references. Equipment hierarchies don’t align. Installation dates are recorded inconsistently or not at all.

This lack of installed base visibility creates tangible business risks. Renewal opportunities slip through the cracks because no single person knows when service contracts expire across the entire customer footprint. Forecasting becomes unreliable when leadership can’t see equipment aging patterns or usage trends. Wallet share erodes as competitors exploit blind spots in the customer relationship. The enterprise has the data — it just can’t access, unify, or activate it effectively.

How the Executive Visibility Gap Impacts Revenue, EBITDA, and Planning

For senior leadership, the executive visibility gap isn’t merely an operational inconvenience, it directly undermines three critical KPIs that define organizational success: revenue growth, EBITDA optimization, and strategic resource allocation.

Revenue Growth Implications

Aftermarket revenue growth depends on knowing what you’ve sold, where it’s deployed, who’s using it, and when it might need service, parts, or upgrades. Without installed base visibility, OEMs operate reactively, responding to inbound service requests rather than proactively driving attachment. Industry data shows that aftermarket services can deliver margins 2-3x higher than new equipment sales, yet many OEMs capture less than 30% of the available aftermarket opportunity within their installed base. The revenue is there, leadership simply can’t see it clearly enough to pursue it systematically.

EBITDA and Profitability Concerns

Industrial OEM data challenges create hidden inefficiency that impacts the bottom line. Sales teams waste time chasing low-probability opportunities instead of focusing on high-propensity accounts with aging equipment. Service organizations dispatch technicians without complete asset histories, leading to longer repair times and return visits. Inventory teams overstock certain parts while running shortages on others because demand forecasting lacks installed base intelligence. Each inefficiency compounds, eroding EBITDA in ways that aren’t immediately visible in financial statements but accumulate substantially over time.

Resource Allocation and Strategic Planning

Perhaps most critically, installed base visibility informs where leadership deploys capital, talent, and strategic focus. Should the company invest in a new service center in the Southeast? The answer depends on installed base density and service contract penetration in that region, data that’s often unavailable or unreliable. Which customer segments deserve dedicated account teams? That requires understanding customer 360 for OEMs not just what they’ve bought recently, but their complete asset portfolio, service history, and growth trajectory.

The “middle 60%” of customers exemplifies this challenge. These mid-tier accounts — too small for dedicated white-glove service, too large to ignore — represent enormous collective value but often receive minimal attention because leadership lacks tools to identify patterns, segment effectively, and allocate resources proportionally. Without visibility, investment decisions become guesswork rather than data-driven strategy.

Top 4 Barriers to Installed Base Visibility in OEMs

Understanding why OEM leaders lack visibility into their installed base requires examining the structural and organizational barriers that perpetuate data silos in manufacturing.

Inconsistent Definitions Across the Enterprise

What exactly constitutes an “asset” in your organization? Different business units may define this differently. Is it a complete machine? Individual subsystems? Serialized components? When one division tracks assemblies while another tracks end products, reconciling installed base data becomes a semantic nightmare. Similarly, customer hierarchies vary — is the corporate parent the customer, or each individual facility? These definitional inconsistencies make asset data unification technically complex and organizationally contentious.

Data Quality and Completeness Issues

Even when systems theoretically contain the right data, quality problems undermine reliability. Serial numbers are recorded inconsistently or contain typos. Installation dates are missing or clearly incorrect. Customer contact information is outdated. Equipment locations are vague (“Texas facility”). When executives can’t trust the data, they won’t use it for decision-making, perpetuating reliance on anecdotal information and tribal knowledge rather than systematic intelligence.

Over-Reliance on Spreadsheets and Business Unit Reports

In the absence of enterprise-wide installed base visibility, organizations default to spreadsheet-based workarounds. Business unit leaders create their own reporting mechanisms, each using different formats and methodologies. These localized solutions may work within individual silos but create chaos at the enterprise level. When leadership requests consolidated views, teams spend days manually combining incompatible spreadsheets, introducing errors and delays that render the resulting analysis stale by the time it reaches executive hands.

Organizational and Cultural Resistance

Data silos persist partly because they serve organizational interests. Business units protect their autonomy and resist standardization efforts that might compromise local flexibility. IT teams are overwhelmed with competing priorities and hesitant to undertake complex integration projects. Sales leaders worry that centralized visibility might expose performance gaps. These human factors — not just technical limitations — perpetuate the executive visibility gap.

How Installed Base Intelligence Solves the Executive Visibility Gap

Breaking through the executive visibility gap requires more than incremental improvements to existing systems. It demands a fundamentally different approach: Installed Base Intelligence a strategic layer that sits between transactional systems and executive decision-making, transforming fragmented data into actionable enterprise intelligence.

Think of Installed Base Intelligence as the missing connective tissue in the industrial OEM technology stack. While ERPs handle transactions and CRM manages opportunities, IBI creates a unified, continuously updated view of what you’ve sold, where it’s deployed, how it’s being used, and what opportunities exist across the entire customer lifecycle.

Creating the Single Pane of Glass

IBI platforms unify disparate data sources through intelligent mapping, matching, and standardization. They reconcile inconsistent customer names using fuzzy logic and hierarchy mapping. Also they connect serial numbers across systems to create complete asset genealogies. They aggregate service events, warranty claims, and contract data into coherent customer profiles. The result is what executives have long sought: a single pane of glass view of the enterprise installed base.

This isn’t just data consolidation — it’s the transformation of how to unify ERP and CRM data in manufacturing into strategic intelligence. The platform becomes the authoritative source for questions like “Where are all our assets deployed in the pharmaceutical industry?” or “Which Fortune 500 customers have aging equipment nearing end-of-life?” or “What’s our service contract penetration by region and product line?”

From Data to Insights to Action

Best practices for aftermarket data visibility extend beyond merely collecting information. Sophisticated IBI implementations embed analytics that generate actionable insights automatically:

- Wallet Share Heatmaps visualize penetration across customer accounts, highlighting where competitors may have displaced you or where expansion opportunities exist

- Business Unit Performance Comparisons enable leadership to identify best practices and underperformers based on installed base monetization

- Revenue Leakage Detection flags contracts nearing expiration, warranty conversions not captured, and service opportunities not pursued

These capabilities transform installed base data from a retrospective record-keeping exercise into a forward-looking growth engine that directly supports aftermarket revenue growth.

4 Steps OEM Leaders Can Take to Build Visibility That Drives Growth

For industrial OEM leaders ready to close the executive visibility gap, a systematic approach delivers sustainable results:

1. Audit Your Data Sources and Architecture

Begin by mapping where installed base data currently resides — every ERP instance, CRM deployment, service system, and spreadsheet. Identify overlaps, gaps, and inconsistencies. This diagnostic reveals the true scope of the enterprise data strategy for OEMs challenge and provides the foundation for remediation planning.

2. Standardize Definitions Enterprise-Wide

Establish common data models for assets, customers, locations, and hierarchies. This requires cross-functional collaboration and executive sponsorship to overcome organizational resistance. The investment in standardization pays dividends in every subsequent analysis and decision.

3. Establish Enterprise Data Governance

Installed base visibility doesn’t happen by accident — it requires ongoing governance. Designate data stewards, establish quality metrics, create feedback loops for continuous improvement, and embed data hygiene into operational workflows rather than treating it as a periodic cleanup project.

4. Implement Installed Base Intelligence Tools

Modern IBI platforms leverage AI and machine learning to automate much of the data unification challenge, dramatically reducing the time and cost of achieving enterprise visibility. These solutions integrate with existing systems rather than requiring wholesale replacement, accelerating time-to-value while minimizing disruption.

From Blind Spots to Strategic Advantage: The OEM Visibility Imperative

The executive visibility gap represents one of the last major blind spots in industrial manufacturing and one of the biggest opportunities. OEM leaders who solve for installed base visibility don’t just improve reporting; they transform their organization’s ability to identify, prioritize, and capture aftermarket revenue systematically rather than opportunistically.

In an era where data-driven decision-making separates market leaders from everyone else, seeing your installed base clearly isn’t a luxury, it’s a competitive imperative. The technology exists. The business case is clear. The question isn’t whether your organization needs installed base visibility, but how quickly you can achieve it.

Want to see your enterprise in one view? Explore how Entytle’s Installed Base Intelligence can unlock hidden aftermarket growth and turn your installed base blind spot into your most valuable strategic asset.