When private equity firms acquire industrial OEMs, the investment thesis looks bulletproof: unlock recurring revenue from the installed base, expand aftermarket margins, and drive sustainable EBITDA growth. It’s compelling on paper. Six months post-close, though, operating partners face a different story—the aftermarket engine promised during diligence is still idling in neutral.

The gap between deal thesis and execution isn’t about understanding the opportunity. PE-Backed OEMs know aftermarket represents one of the highest-margin plays in industrial sectors. The problem is turning that strategic intent into measurable results within the compressed timelines that define value creation.

When Deal Models Hit Reality

Private equity deal models routinely project double-digit EBITDA improvements from aftermarket expansion. These projections assume portfolio companies can systematically convert one-time equipment buyers into recurring revenue customers through service contracts, parts sales, and upgrades.

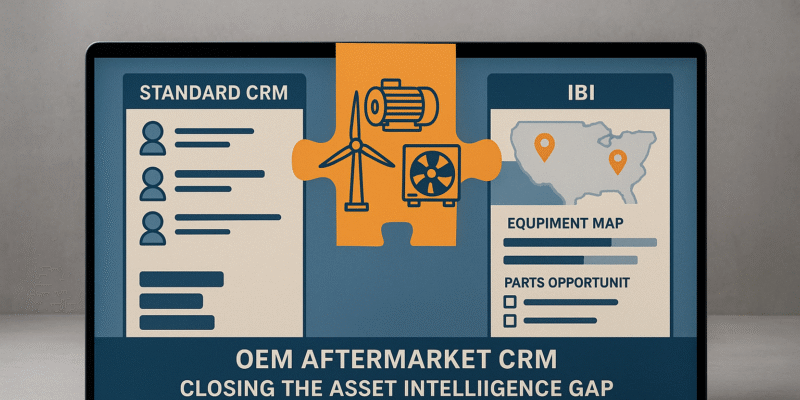

But here’s what those models miss: most PE-Backed OEMs don’t have the foundational data to execute this strategy. The installed base—every piece of equipment operating in the field—exists as scattered fragments across CRM systems, service tickets, spreadsheets, and in the heads of veteran service managers. Without knowing what equipment exists, where it’s deployed, who owns it, and its service history, aftermarket strategies stay theoretical.

This gap hits hard under PE ownership. Operating partners arrive with 90-day plans and quarterly board metrics, then discover basic questions have no answers: Which customers represent the highest lifetime value? Which machines need service next quarter? What’s our actual service contract penetration? Where are we losing parts sales to third parties?

The predictable result: aftermarket initiatives launch without clear targeting, sales teams lack prioritized lists, and forecasts disconnect from reality. Value creation timelines slip while competitors with better data move faster.

PE-Backed OEMs | Numbers Don’t Lie

The financial case for aftermarket is beyond debate. McKinsey research across 30 industries shows that average EBIT margins for aftermarket services hit 25%, compared to just 10% for new equipment. According to Deloitte, aftermarket services contribute 25-30% of manufacturers’ revenue but represent over 50% of profits due to fundamentally better economics: lower cost of sales, stickier customers, and predictable demand tied to equipment lifecycles.

For PE-backed OEMs, aftermarket offers something rare—margin expansion and revenue stability in one package. Equipment sales swing with economic cycles and CapEx budgets. Aftermarket spending proves more resilient. Machines need maintenance whether customers are expanding or conserving cash.

Yet most PE-Backed OEMs capture a fraction of what’s available. Service contract penetration often sits below 30% of the installed base. Parts revenue leaks to third-party suppliers competing on price. Service stays reactive—fixing breakdowns instead of preventing them.

This isn’t about lack of ambition. Leadership teams see the opportunity. The constraint is operational: without comprehensive installed base intelligence, companies can’t segment effectively, can’t prioritize outreach based on equipment condition, and can’t forecast parts demand with any confidence.

The fragmented nature of aftermarket operations makes it worse. Service, parts, and sales operate in silos with separate systems and conflicting incentives. A technician knows a customer’s equipment is approaching end-of-life—an upgrade opportunity—but that insight never reaches sales. Parts data sits in inventory systems disconnected from CRM. Revenue opportunities hide in organizational blind spots.

Why Execution Keeps Failing

The root cause traces to data infrastructure—or the lack of it. Most industrial OEMs grew through acquisition and geographic expansion, layering legacy systems that never talked to each other. The result is chaos.

Customer records have inconsistent naming conventions, making account consolidation nearly impossible. Equipment serial numbers exist in service databases but not CRM. Configuration details live in engineering files that sales can’t access. Warranty status, service history, and parts consumption scatter across disconnected platforms.

Then there’s tribal knowledge. Long-tenured service managers remember customer histories and equipment quirks that never enter formal systems. This institutional knowledge walks out the door at retirement, taking revenue intelligence with it.

Outdated systems add another layer of friction. Many PE-Backed OEMs run ERP platforms from decades ago, built for transaction processing, not insight. These systems track what happened but don’t enable forward-looking strategy. Asking “Which customers should we target for service renewals this quarter?” requires manual extraction, Excel gymnastics, and educated guessing.

Performance visibility suffers accordingly. PE operating partners can’t answer fundamental questions: What’s our actual installed base size? How does service contract penetration vary by segment or region? Which product lines generate the highest aftermarket margins? Where are we losing parts sales?

Without visibility, improvement lacks direction. Sales comp misaligns with aftermarket priorities. Resource allocation happens through anecdote rather than analysis. Quarterly targets become aspirational.

The Leading Firms’ Playbook

Sophisticated PE sponsors recognize that aftermarket value creation requires early, deliberate investment in data infrastructure. Rather than treating it as a later-stage optimization, they prioritize it immediately and tie initiatives directly to EBITDA goals.

The playbook starts with installed base intelligence. Leading sponsors mandate comprehensive data consolidation in the first 100 days, creating a single source of truth for equipment, customers, and service history. This foundation enables everything else: targeted campaigns, usage-based service offerings, predictive maintenance, and strategic parts pricing.

They implement governance that breaks organizational silos. Cross-functional teams spanning sales, service, and parts get shared incentives tied to aftermarket penetration metrics. Technology platforms—specifically designed for installed base management—replace spreadsheets and tribal knowledge.

Critically, these firms establish clear metrics linked to value creation. Instead of vague directives to “grow aftermarket,” they define specifics: achieve 45% service contract penetration in 18 months, reduce third-party parts leakage by 20% in year one, increase aftermarket revenue per unit by X dollars annually. These cascade into operational dashboards providing real-time execution visibility.

The investment thesis shifts from assumption to accountability. Deal models promise growth, but leading PE firms build the infrastructure to deliver it. They recognize that strategy without execution capability is fiction, and execution depends on data.

Installed Base Intelligence Changes the Game

Installed Base Intelligence is the critical enabler that transforms aftermarket intent into EBITDA reality. It’s the unified, actionable view of every piece of equipment in the field, every customer relationship, and every revenue opportunity across the asset lifecycle.

This intelligence layer connects disparate sources—CRM, ERP, service management, warranty systems, IoT sensors—into a coherent platform. It answers the questions aftermarket strategies depend on: Who owns what equipment? Where is it? What’s its service history? When does warranty expire? What’s the expected parts consumption? Which customers represent the highest lifetime value?

With comprehensive installed base intelligence, PE-backed OEMs can execute strategies that were previously theoretical. Proactive service outreach becomes possible when systems flag equipment approaching maintenance intervals. Parts forecasting improves when consumption patterns by equipment type become visible. Cross-sell opportunities surface automatically when systems identify gaps in customer operations.

The impact on value creation timelines matters intensely. Rather than spending year one building basic infrastructure, OEMs with installed base intelligence execute revenue initiatives immediately. Service contract campaigns launch with precise targeting. Parts pricing optimizes by product line competitive position. Sales teams get prioritized account lists ranked by opportunity size.

It transforms performance management too. Real-time dashboards track aftermarket KPIs by business unit, geography, and product line. Operating partners spot underperforming segments and reallocate resources. Board reporting shifts from lagging indicators to leading metrics that predict EBITDA performance.

The speed advantage is critical in PE contexts where value creation compresses into 3-5 year holds. Every quarter building infrastructure is a quarter not generating incremental EBITDA. Installed Base Intelligence collapses that timeline, enabling portfolio companies to monetize aftermarket in months, not years.

PE-Backed OEMs | From Theory to Results

The gap between PE deal thesis and aftermarket execution isn’t inevitable. It’s a data problem with proven solutions. OEMs that implement comprehensive Installed Base Intelligence transform aftermarket from untapped potential into a systematic value creation engine.

For PE firms evaluating portfolio performance or new acquisitions, the question isn’t whether aftermarket represents an opportunity—clearly it does. The question is whether your portfolio company has the data infrastructure to capture that opportunity within your timeline.

Bridging this gap requires purpose-built technology designed for installed base management in industrial contexts. It requires organizational commitment to data consolidation, cross-functional collaboration, and metric-driven execution. Most importantly, it requires starting now rather than deferring digital transformation until “after we stabilize operations.”

Portfolio companies that deliver on their aftermarket thesis treat Installed Base Intelligence as foundational infrastructure, not optional enhancement. They’re translating PE intent into measurable EBITDA reality.

See how Entytle bridges deal intent with aftermarket execution. Discover how leading PE-backed OEMs are transforming their installed base into a systematic growth engine—and achieving EBITDA improvements in 90 days rather than years.