You have invested substantially in modernizing your core enterprise systems. Whether it’s a multi-million-dollar ERP overhaul or the global rollout of a new CRM and Field Service platform, the promise is the same: a holistic view of the customer and your assets.

Yet, when Service or Aftermarket leaders ask one crucial question – “What exact equipment does Customer X have, and which high-value parts are nearing end-of-life?” – the answer still isn’t found in the new platform. Instead, it surfaces only after a scramble through disparate legacy systems, manual Excel logs, and the tribal knowledge of long-time service technicians.

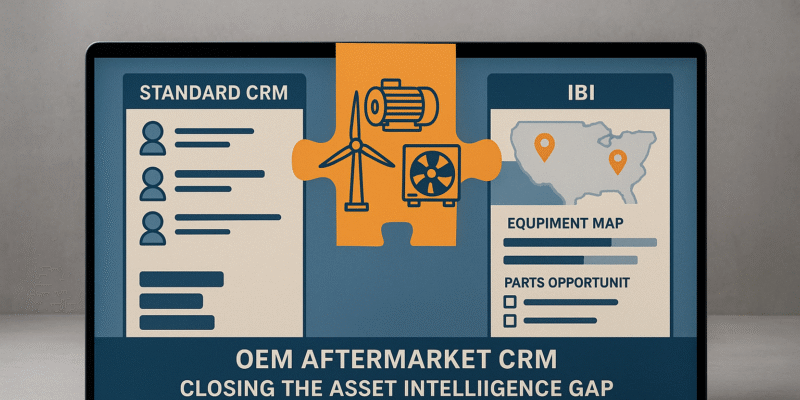

This is the CRM Paradox. These powerful systems are brilliant at managing transactions and customer interactions, but they fundamentally struggle to model the dynamic, complex relationships required to build a true Installed Base Intelligence. This gap is not a technology failure, but a data modeling challenge – and it’s the core reason critical aftermarket and service initiatives get stalled right at the contract stage.

In this post, we explore why this foundational data challenge exists and how manufacturers can build the relational structure needed to unlock millions in proactive service revenue.

The Core System Blind Spot: Transactional vs. Relational

The fundamental issue lies in the design architecture of your foundational software.

Your Enterprise Resource Planning (ERP) system, the backbone for systems like Oracle, is engineered for finance, inventory, and transaction history. When a piece of equipment is sold, the ERP registers it as an “order”. Once that order is processed, the system moves on; it does not track that order as a living, breathing installed-base object.

Similarly, your Customer Relationship Management (CRM) platform, such as Dynamics, excels at managing user interactions, sales opportunities, and field service workflows. However, it often inherits the transactional limitations of the ERP.

The result is a crucial missing link: the ability to continuously model the complex, hierarchical relationships necessary for proactive service. For example, the system fails to map which specific belt or high-wear component is installed on which specific conveyor line at a customer’s site. This relational gap means that critical questions like “Conveyor Line 4 is down – which belt is responsible?” cannot be answered systematically.

The Two Biggest Installed Base Challenges

The inability of core systems to maintain a relational view leads directly to two distinct challenges that consistently trip up digital transformation projects:

1. The Data Fragmentation and Unstructured Reality

The data necessary to fuel a proactive service strategy is inherently scattered and unstructured. It’s never in one place, even after a Dynamics rollout. You have:

- Transactional Data: Order history and key financial data stuck in the ERP (e.g., Oracle).

- Field Data: Health checks, audits, and manual pilot results captured in Excel spreadsheets.

- Equipment Data: Often living in separate, siloed systems, leaving the critical relationship between specific parts and specific equipment missing.

Without a dedicated layer to consolidate, normalize, and disambiguate this data across systems , teams are left managing manual pilots and struggling to achieve a structured, centralized view.

2. The Core Issue is Modeling, Not Just Cleaning

Many internal IT initiatives assume the problem is simply “dirty data” that needs to be cleaned and deduplicated. But sophisticated aftermarket leaders know the core issue runs deeper: it is a modeling/structure problem.

The goal isn’t just to clean the data; it’s to transform unstructured transactions into a usable installed-base view. Until you can map the relationships (e.g., linking a component replacement to its specific parent equipment), you cannot enable the high-value use cases that drive revenue, such as proactive replacement of parts nearing end-of-life or automated, data-driven aftermarket opportunities.

The Strategic Pivot: Complement, Don’t Compete

When you introduce a specialized installed base intelligence platform, you often face the immediate objection: “We just invested in a major system; shouldn’t we be doing more with what we already bought?” This is why many deals stall—the project is perceived as a competing initiative that adds bandwidth pressure and risks derailing existing transformation efforts.

The strategic pivot is to ensure your solution is presented as a complementary intelligence layer, not a replacement. You are not asking the customer to abandon their existing Dynamics or Oracle investments. Instead, the specialized platform’s role is to:

- Structure and Model Data: Take the raw transaction, equipment, and field-survey data already residing in those systems and transform it into a functional, relational Installed Base view.

- Automate Use Cases: Turn manual, spreadsheet-based pilots (like EOL tracking or health checks) into automated, data-driven aftermarket opportunities.

By operating as the glue and the intelligence engine that makes the existing stack profitable, you eliminate the “competing initiative” block.

Next Steps: Starting Small

Waiting until your organization’s full ERP or Field Service rollout stabilizes is a recipe for project stall. With no fixed deadline or burning platform, this high-value initiative is easily deprioritized behind other IT and CX work.

The solution is not to push the “big project,” but to propose a small, survivable experiment. When dealing with capacity-constrained leadership, you must minimize internal FTE demand and de-risk the commitment.

The path forward is a narrow, time-boxed pilot that aims for a quick, measurable win:

- Scope Reduction: Focus on one product family or a single region.

- Data Ingestion: Ingest data only from the necessary sources (e.g., ERP + CRM + 1–2 field spreadsheets) to achieve the minimal viable Installed Base view.

- Measurable Outcomes: Deliver 2–3 proactive campaigns (e.g., EOL belt identification or top upgrade candidates).

- Time-Bound: Define it clearly (e.g., 3 months) with a commitment to an explicit “expand/pause/stop” decision at the end.

By successfully completing a small-scope, high-value pilot, you move the conversation from discussing capability to celebrating results, effectively earning the right to pursue the full installed base intelligence you always envisioned.