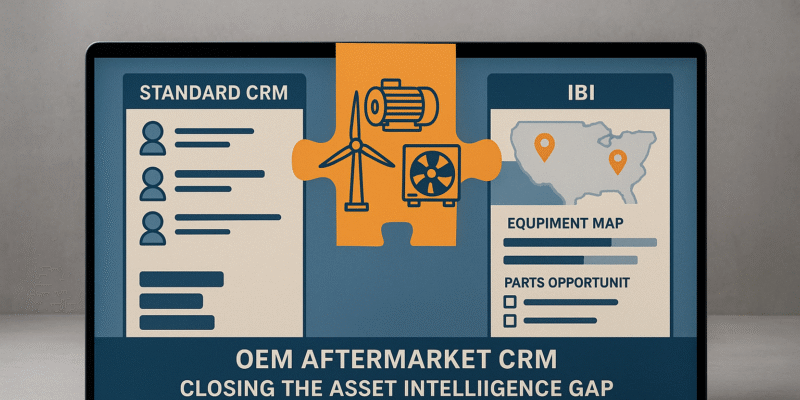

TL;DR: Standard OEM aftermarket CRM systems track customer contacts and sales pipelines, but they weren’t designed to manage complex equipment assets across their lifecycle. For OEMs generating 40-70% of revenue from aftermarket parts and services, this gap means missed cross-sell opportunities, reactive service delivery, and invisible revenue potential sitting in your installed base. The solution isn’t replacing your CRM—it’s augmenting it with Installed Base Intelligence that connects your equipment, parts, and customer data into actionable insights.

Key Takeaways

- Standard OEM aftermarket CRM systems are contact-centric, not asset-centric: They excel at tracking who bought what, but fail to connect machines, parts, service history, and lifecycle revenue opportunities across multiple systems.

- The aftermarket blind spot costs OEMs millions: Without visibility into what equipment is installed where, when it needs service, and which parts drive recurring revenue, OEMs operate reactively instead of strategically.

- Installed Base Intelligence bridges the CRM gap: Asset-centric platforms integrate ERP, CRM, and IoT data to create a single source of truth for every machine, customer, and revenue opportunity.

- Data-driven aftermarket growth is measurable: OEMs augmenting their aftermarket CRM with IBI report 15-25% increases in aftermarket revenue, 30% improvements in customer retention, and 40% reductions in quote response times.

- Your OEM aftermarket CRM isn’t the problem—it’s incomplete: The right approach pairs your existing CRM’s relationship management with purpose-built intelligence for installed base monetization.

What Problem Are OEMs Actually Trying to Solve?

If you’re a VP of Aftermarket at an industrial OEM, you’ve likely asked yourself: “Why don’t we know what we’ve sold, where it is, and when it needs service?”

You have an OEM aftermarket CRM—probably Salesforce or Microsoft Dynamics. Your sales team uses it religiously to track opportunities and accounts. But when a service engineer needs to know which specific compressor model a customer installed in 2018, or when your parts team wants to identify customers due for preventive maintenance kits, your aftermarket CRM goes silent.

The reason is simple: standard CRM platforms were designed for transactional B2B sales, not for managing complex, long-lifecycle industrial assets. For consumer software or professional services companies, that’s fine. For OEMs manufacturing equipment that operates for 15-30 years and generates 3-5x the original equipment cost in aftermarket revenue, it’s a strategic blind spot.

This article explores why traditional OEM aftermarket CRM solutions fall short for parts and service businesses, what capabilities are missing, and how Installed Base Intelligence (IBI) fills the gap to unlock millions in aftermarket revenue.

What Does OEM Aftermarket CRM Do Well?

Let’s be fair to your CRM investment. These platforms excel at specific functions that remain valuable for OEM businesses:

Pipeline visibility and forecast accuracy: CRMs track opportunities from lead to close, helping sales leaders forecast quarterly new equipment sales with reasonable precision. For original equipment transactions, this visibility is essential.

Relationship management: Your account executives can log interactions, schedule follow-ups, and maintain contact histories for key decision-makers at customer facilities. This relationship tracking helps maintain account continuity when personnel changes occur.

Reporting on sales activities: Dashboards show sales velocity, win rates, and rep productivity—critical metrics for managing new equipment sales teams. Sales leaders can identify coaching opportunities and forecast headcount needs.

Integration with marketing automation: Modern CRM systems connect with email platforms, webinar tools, and content management systems to nurture leads through the awareness and consideration stages. For demand generation on new equipment, these integrations drive efficiency.

For new equipment sales, OEM aftermarket CRM platforms deliver genuine value. The problem emerges when OEMs try to force these contact-centric systems to manage asset-centric aftermarket businesses—specifically parts sales, service contracts, and lifecycle revenue optimization.

Where Does OEM Aftermarket CRM Fail Original Equipment Manufacturers?

The limitations of standard aftermarket CRM for OEMs become painfully clear when parts and service teams try to answer fundamental business questions:

The Asset Visibility Problem

What traditional OEM aftermarket CRM systems can’t tell you:

- Which specific equipment (model, serial number, configuration) is installed at each customer location

- What parts and consumables each machine requires based on its configuration

- When equipment was commissioned and what its expected lifecycle stage is

- Which assets are approaching warranty expiration or service intervals

- What the total installed base opportunity is by customer, product line, or region

Your aftermarket CRM shows you sold five hydraulic presses to ABC Manufacturing. It doesn’t know that three are Model HP-5000s requiring annual seal kits (worth $2,400 each), one is an HP-7500 with a proprietary filtration system (generating $8,500 in annual consumables), and one was decommissioned last year (representing zero future revenue potential).

This visibility gap means your parts team can’t proactively reach out with the right products at the right time. Instead, you wait for customers to call—often after equipment has already failed or when competitors have already made contact.

The Fragmented Data Challenge

Most OEMs operate with severely fragmented data ecosystems that standard CRM platforms cannot unify:

- 3-7 different ERP systems (from acquisitions, regional operations, or product line silos)

- Multiple CRM instances (corporate Salesforce plus divisional systems, often with duplicate or conflicting customer records)

- Spreadsheets and tribal knowledge (the service manager who “just knows” customer histories but is three years from retirement)

- Disconnected IoT and telematics data (if your equipment is connected at all, this data lives in yet another system)

- Legacy databases (parts catalogs, warranty systems, and service history in platforms that don’t integrate with modern CRM)

Traditional OEM aftermarket CRM platforms don’t integrate this fragmentation—they add another silo. Your sales rep sees opportunity history in CRM, but the parts your customer actually needs are buried in an ERP in Germany. The service history is in a field service management system. The equipment warranty status exists in another database entirely. The IoT data showing declining equipment performance lives in a telematics platform no one checks.

The result: Your team manually cobbles together information from five different systems to answer one customer question. Quote times stretch from hours to days. Revenue opportunities slip through the cracks. Competitors with better data integration win the business.

The Lifecycle Revenue Invisibility

Consider the economics of industrial equipment: A $500,000 piece of material handling equipment will generate $1.5-2.5 million in parts, consumables, and service revenue over its 20-year operational life. But traditional aftermarket CRM for OEMs tracks that initial $500K transaction and goes dark on the long-term opportunity.

The critical questions your OEM aftermarket CRM can’t answer:

- Which customers represent the highest lifetime value based on their installed base composition?

- Which assets are approaching service intervals that represent upsell opportunities for parts bundles or service contracts?

- Which customers have aging equipment due for technology upgrades or full replacements?

- What’s the total addressable aftermarket opportunity in our installed base by product line, region, or customer segment?

- Which customers are at risk of churn based on declining parts purchases or service engagement?

- Where are we leaving money on the table with incomplete parts coverage or expired service contracts?

Without these answers, aftermarket sales is entirely reactive. Customers call when something breaks. You quote reactively, often competing on price alone. Competitors who proactively reach out with service reminders, predictive maintenance offers, and upgrade proposals win the business—and the long-term customer relationship.

What’s Missing: Installed Base Intelligence for OEM Aftermarket

Installed Base Intelligence (IBI) represents a fundamentally different approach—one designed specifically for OEMs’ aftermarket business models and the limitations of standard CRM platforms.

Asset-Centric, Not Contact-Centric

While traditional OEM aftermarket CRM organizes information around people (contacts) and companies (accounts), IBI organizes around equipment as the central data object. Every machine becomes a revenue-generating asset with:

- Complete configuration and parts hierarchy: Every component, sub-assembly, and consumable associated with each piece of equipment

- Service and maintenance history: Complete timeline of work performed, parts replaced, and technician notes

- Performance data: If IoT-enabled, real-time or historical operating parameters that predict service needs

- Warranty and contract status: Current coverage, expiration dates, and renewal opportunities

- Predictive service and parts opportunities: AI-driven recommendations based on equipment age, usage patterns, and service intervals

This asset-centric view transforms how aftermarket teams operate—from reactive order-takers to proactive advisors who understand customer operations better than customers understand them themselves.

Data Integration at Scale

Modern IBI platforms don’t replace your OEM aftermarket CRM or ERP systems—they connect them into a unified intelligence layer. Using AI-powered data harmonization, IBI systems:

- Ingest equipment data from multiple ERPs, regardless of format, structure, or location (on-premise or cloud)

- Reconcile customer records across systems, solving the “ABC Manufacturing” vs. “ABC Mfg Co.” vs. “ABC Manufacturing Inc.” problem that plagues multi-system environments

- Link CRM opportunity histories to specific installed equipment, connecting the original equipment sale to the lifetime aftermarket opportunity

- Incorporate IoT telemetry when available, adding real-time equipment performance data to historical patterns

- Normalize parts databases across product lines and geographies, enabling cross-sell recommendations and unified pricing

- Maintain data quality over time, identifying duplicates, filling gaps, and flagging inconsistencies

The result is a single source of truth for your installed base: every machine, at every customer, with its complete lifecycle context—all accessible to sales, service, and parts teams without manual data gathering.

Actionable Intelligence, Not Just Data

Data integration alone isn’t enough to overcome OEM aftermarket CRM limitations. The transformative capability is translating that unified data into revenue opportunities:

Predictive parts recommendations: IBI systems identify which customers need which parts based on equipment age, usage patterns, and service intervals—before customers even know they need them. Sales reps receive prioritized lists of opportunities with expected order values and recommended messaging.

Customer health scoring: Assess account risk based on service engagement, parts purchasing patterns, and equipment age to prioritize retention efforts. Red-flag accounts showing declining engagement receive proactive outreach before they defect to competitors or third-party service providers.

Whitespace analysis: Identify customers with incomplete parts coverage or service contracts, quantifying the specific revenue opportunity. “Customer XYZ has 12 units but only purchases parts for 7—$45K annual opportunity.”

Warranty-to-service contract conversion: Flag equipment approaching warranty expiration with automated campaigns to convert to service agreements. Time these campaigns for 90-120 days before expiration when customers are most receptive.

Service interval alerts: Proactively reach out to customers 60-90 days before scheduled maintenance windows with parts kits, technician scheduling, and service contract offers.

How Does This Actually Work? Representative Use Cases

The following examples illustrate typical use cases and represent composite scenarios based on industry benchmarks and common OEM aftermarket challenges.

Use Case 1: Proactive Parts Sales Beyond CRM Capabilities

A typical scenario involves commercial HVAC OEMs struggling with reactive parts sales despite having a robust aftermarket CRM system. When multiple regional ERP systems and corporate CRM data are integrated through an IBI platform, the system can identify equipment reaching critical service intervals—such as rooftop units between 7-9 years old approaching optimal compressor replacement windows.

Traditional OEM aftermarket CRM platforms would show these customers as accounts with historical purchases, but provide no intelligence about specific equipment needs or timing.

With IBI augmenting their aftermarket CRM, teams can:

- Launch targeted campaigns offering preventive component replacements with volume discounts, reaching customers before failures occur

- Equip sales reps with specific equipment lists for each account, including model numbers, installation dates, and recommended parts

- Track campaign ROI and conversion rates through the platform, measuring which customer segments and product lines generate the highest returns

- Automate follow-up sequences based on customer engagement with initial outreach

Typical results: Industry benchmarks show 25-35% conversion rates on proactive parts campaigns, generating millions in incremental parts revenue while improving customer satisfaction through planned maintenance versus emergency failures. Average order values increase 40-60% when customers purchase preventive maintenance kits versus individual emergency parts.

Use Case 2: Service Contract Expansion Through Asset Intelligence

Food processing and material handling equipment manufacturers commonly face challenges growing service contract penetration beyond 20-30% of their installed base. Their OEM aftermarket CRM systems show contract statuses but not the underlying opportunity or total addressable market within the installed base.

IBI analysis integrated with aftermarket CRM data typically reveals:

- 60-70% of installed bases are 5+ years old (prime service contract candidates who’ve experienced equipment issues and understand downtime costs)

- Customers with service contracts purchase 3-4x more parts annually than those without, representing significant wallet-share capture

- Geographic clusters of uncontracted equipment exist near existing service territories, enabling efficient technician routing and cost-effective service delivery

- Specific equipment models have higher service contract conversion rates, enabling targeted campaigns with proven ROI messaging

With equipment-specific targeting, ROI calculators showing potential downtime costs, and CRM-integrated workflows for proposal generation and follow-up, OEMs in this category typically increase contract penetration to 40-50% within 12-18 months—adding $10-20M in recurring revenue for mid-sized manufacturers.

The key difference from standard OEM aftermarket CRM approaches: Instead of generic “renew your service contract” campaigns to all accounts, IBI enables personalized outreach like: “Your three Model XYZ-500 units at the Springfield facility are now 7 years old. Units at this age experience 2.3 service events annually averaging $8,400 in downtime costs. Our service contract eliminates 89% of unplanned downtime for $4,200 annually per unit.”

Use Case 3: Customer Retention Through Predictive Insights

Turbomachinery and heavy equipment OEMs frequently face competitive pressure in aftermarket service despite having sophisticated CRM systems. They lose business to third-party service providers because standard OEM aftermarket CRM platforms can’t proactively engage customers before service events occur.

IBI implementation integrated with existing aftermarket CRM typically enables:

- Service interval tracking across the entire installed base, with automated alerts to account managers 60-90 days before scheduled maintenance

- Performance benchmarking to identify underperforming assets, creating upsell opportunities for upgrades, retrofits, or replacements backed by data showing ROI

- Parts consumption analysis to detect declining engagement, flagging customers who’ve reduced parts purchasing (churn risk indicators) for immediate intervention

- Competitive win-back campaigns, identifying customers who’ve stopped purchasing OEM parts and quantifying the quality/warranty risks of third-party alternatives

Representative impact: Customer retention improvements from 65-70% to 85-90% in aftermarket services are common, with 35-45% of accounts increasing service spending year-over-year. More importantly, average customer lifetime value increases 2-3x when retention improves, dramatically impacting enterprise valuation.

Representative Scenario: From Reactive CRM to Revenue-Generating Intelligence

Consider a typical industrial OEM scenario—a mid-sized manufacturer of industrial motors or pumps with $200-300M in annual revenue. Like many OEMs, they have excellent new equipment sales visibility through their aftermarket CRM, but virtually no aftermarket intelligence, despite equipment generating 60-70% of gross margin through 15-25 year service lives.

Common challenges in this scenario:

- Equipment data lives in three or more ERP systems (from acquisitions and legacy platforms)

- Field service uses disconnected systems or paper work orders later entered manually

- Their OEM aftermarket CRM shows tens of thousands of units sold but can’t identify which customers have what specific equipment installed

- Parts sales are 85-95% reactive (customer-initiated), with sales reps acting as order-takers rather than trusted advisors

- Service contract penetration stagnates at 25-30% despite enormous potential

- Competitors gain ground by offering proactive service, even with inferior products

The IBI transformation pattern augmenting existing CRM:

Within 3-6 months of implementing Installed Base Intelligence alongside their aftermarket CRM, organizations in this category typically achieve:

- Unified data from multiple ERPs and field service records, creating visibility into 80-90% of the installed base with complete equipment profiles

- Equipment profiles for each asset including serial numbers, customer locations, installation dates, configuration details, and parts hierarchies

- Identification of thousands of assets approaching key service intervals, representing $15-30M in addressable aftermarket opportunity previously invisible to the CRM

- Launch of predictive parts campaigns targeting these specific assets with personalized messaging based on equipment age, model, and customer industry

- CRM workflow integration so sales reps receive prioritized opportunity lists with talking points, recommended parts, and expected order values

Typical year-one results based on industry benchmarks:

- Aftermarket revenue increases of 18-25% from improved parts sales, service contract penetration, and customer retention

- Parts quote response time decreases from 2-4 days to 4-8 hours by eliminating manual data gathering across systems

- Service contract renewals improve from 55-65% to 75-85% through proactive engagement before expiration

- Sales rep productivity (revenue per rep) increases 25-40% as reps spend less time hunting for data and more time selling

- Customer satisfaction scores improve 15-20 points as OEMs demonstrate expertise about customer equipment and operations

Most significantly, OEMs shift from competing on price for reactive parts orders to demonstrating value through proactive expertise—fundamentally changing customer conversations and competitive positioning. The OEM aftermarket CRM becomes more valuable as it’s enriched with installed base intelligence that drives systematic, repeatable revenue growth.

Why This Matters Now: The PE and Digital Transformation Context

If you’re reading this as a private equity investor who owns OEMs, or a Chief Digital Officer tasked with aftermarket growth, the business case for augmenting your OEM aftermarket CRM with Installed Base Intelligence is compelling:

Aftermarket revenue trades at higher multiples than equipment sales due to recurring nature, higher margins, and lower capital intensity. Improving aftermarket performance 15-20% can increase enterprise valuation 25-40%. For PE firms, this represents the fastest path to value creation within portfolio OEM companies.

Competitors are moving: Best-in-class OEMs are already operationalizing installed base data to augment their CRM capabilities. The competitive advantage window is narrowing. OEMs that wait 12-24 months will face competitors with superior customer intelligence, making market share recovery difficult and expensive.

The technology barrier is gone: Cloud-based IBI platforms implement in weeks, not years, without replacing existing OEM aftermarket CRM or ERP systems. Implementation risk is minimal, and ROI timelines are measured in months, not years.

Executive teams need this visibility: CEOs, CFOs, and boards increasingly demand data-driven insights about installed base monetization. “How much aftermarket opportunity exists in our installed base?” is a question standard CRM platforms simply cannot answer.

What Should You Do Next?

The path forward isn’t replacing your OEM aftermarket CRM—it’s recognizing what CRM was designed to do (manage selling relationships) and what it wasn’t (monetize complex installed bases). Here’s a pragmatic roadmap:

Step 1: Assess Your Installed Base Visibility

Start by answering these fundamental questions:

- How many assets do you have in the field? Can you answer this within 10% accuracy?

- What percentage can you identify by serial number, customer, and location? Most OEMs discover they have visibility into less than 60% of their installed base.

- What’s your data fragmentation situation? How many ERPs, CRMs, and legacy systems contain pieces of the puzzle?

- What’s your current aftermarket revenue per installed asset vs. potential? Industry benchmarks can quantify the gap.

- How long does it take to answer: “What equipment does Customer ABC have installed?” If the answer is more than 60 seconds, you have a problem.

Step 2: Quantify the Opportunity

Work with your finance team to calculate:

- Total addressable aftermarket opportunity in your installed base (parts, service, contracts)

- Current capture rate (actual aftermarket revenue ÷ total opportunity)

- Revenue potential from improving capture rate by 10%, 20%, or 30%

- Customer lifetime value with current retention rates vs. improved retention through proactive engagement

This analysis typically reveals $20-100M+ in unrealized annual revenue for mid-sized OEMs—enough to justify immediate action.

Step 3: Pilot with a High-Value Product Line

Don’t attempt to integrate everything at once. Choose equipment with:

- Strong aftermarket potential (high parts consumption, recurring service needs)

- Reasonable data quality in at least one system (clean serial number records, customer associations)

- Executive sponsorship (a product line GM who wants to prove the concept)

Integrate that product line’s data first, measure impact on parts sales, service contract penetration, and customer retention. Use the pilot results to justify broader rollout.

Step 4: Connect Your Data, Don’t Create Another Silo

Modern IBI platforms integrate with existing OEM aftermarket CRM and ERP systems, augmenting them rather than replacing them. Look for solutions that:

- Work with your current technology stack (Salesforce, SAP, Oracle, Microsoft Dynamics, etc.)

- Don’t require replacing existing systems (implementation risk is significantly lower)

- Provide APIs and integrations for future scalability

- Offer AI-powered data harmonization to handle messy, inconsistent data (because that’s the reality)

The goal isn’t another system for your team to log into—it’s intelligence layers that flow into existing workflows.

The Bottom Line: Your OEM Aftermarket CRM Needs Installed Base Intelligence

Your OEM aftermarket CRM isn’t failing you—it’s doing exactly what it was built to do. The gap isn’t a flaw in your sales process; it’s a fundamental mismatch between contact-centric software and asset-centric business models.

For OEMs where 40-70% of revenue and most of the profit comes from installed base monetization, that gap represents millions in unrealized revenue. Equipment sitting in the field, generating no parts sales. Service contracts not renewed because outreach came too late. Upgrade opportunities invisible to your sales team because asset data lives in disconnected systems.

Entytle’s Installed Base Intelligence platform was purpose-built to solve this challenge—connecting fragmented equipment data across ERPs and CRMs into a single, actionable view of your installed base. The result: proactive parts sales, intelligent service contract growth, and measurable aftermarket revenue increases that standard OEM aftermarket CRM platforms simply cannot deliver.

The question isn’t whether to augment your aftermarket CRM with IBI. It’s whether you can afford not to while competitors are already making this shift—and winning your customers with superior intelligence about their own operations.

Ready to see what Installed Base Intelligence can reveal about your aftermarket opportunity? Contact Entytle to schedule an installed base assessment and discover the revenue hiding in your data.