Industrial OEM Performance Report Q1 2020

The quarterly performance report for Industrial OEM’s is out for Q1 2020. We sifted through the comprehensive set of statistics published by census.gov and distilled the data for industrial manufacturing.

The primary sub-sectors addressed are – HVAC Equipment, Industrial Machinery, Mining, Oil/Gas Field, Turbines, Generators, Power Transmission, Material Handling, and Construction Machinery.

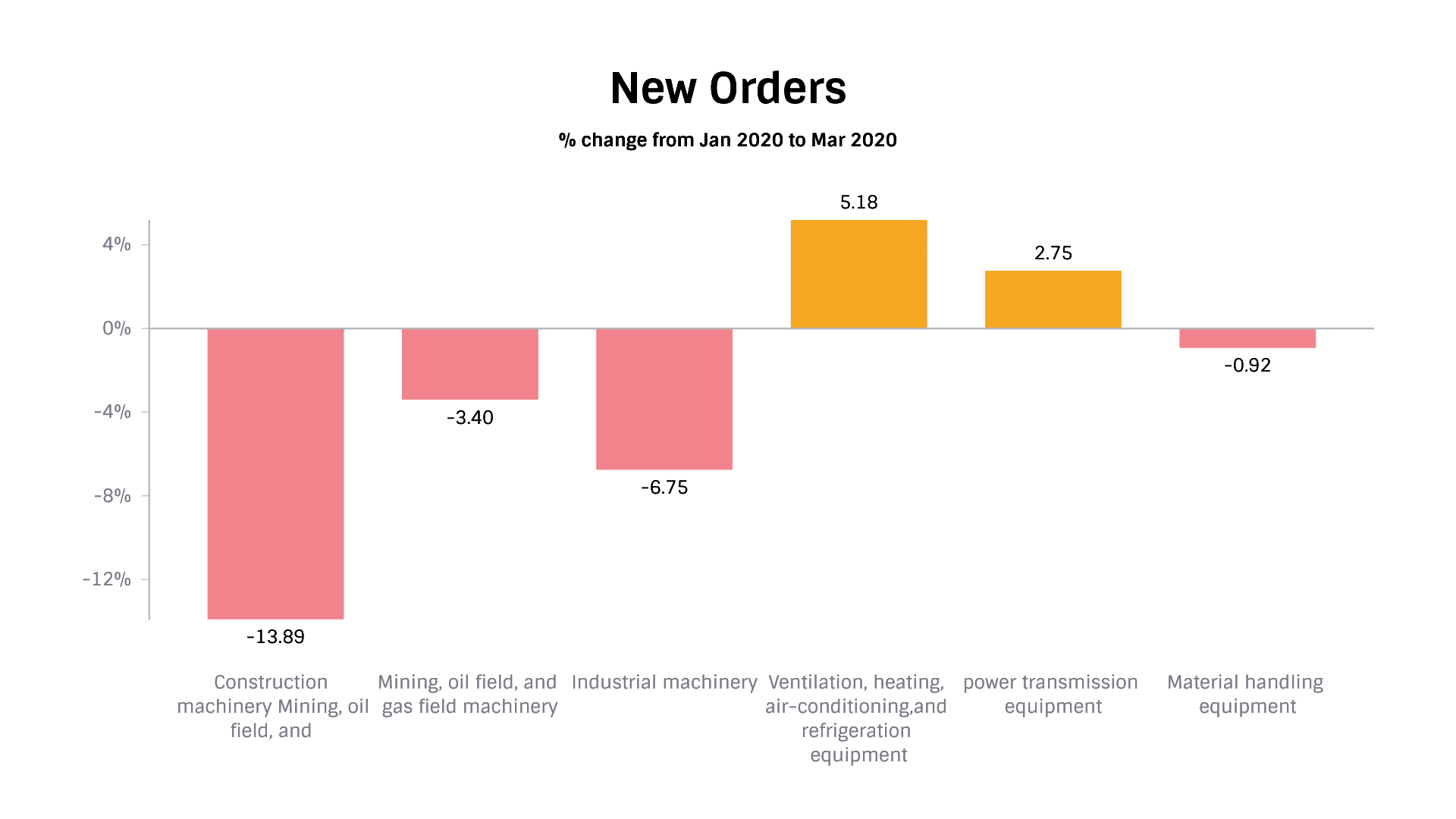

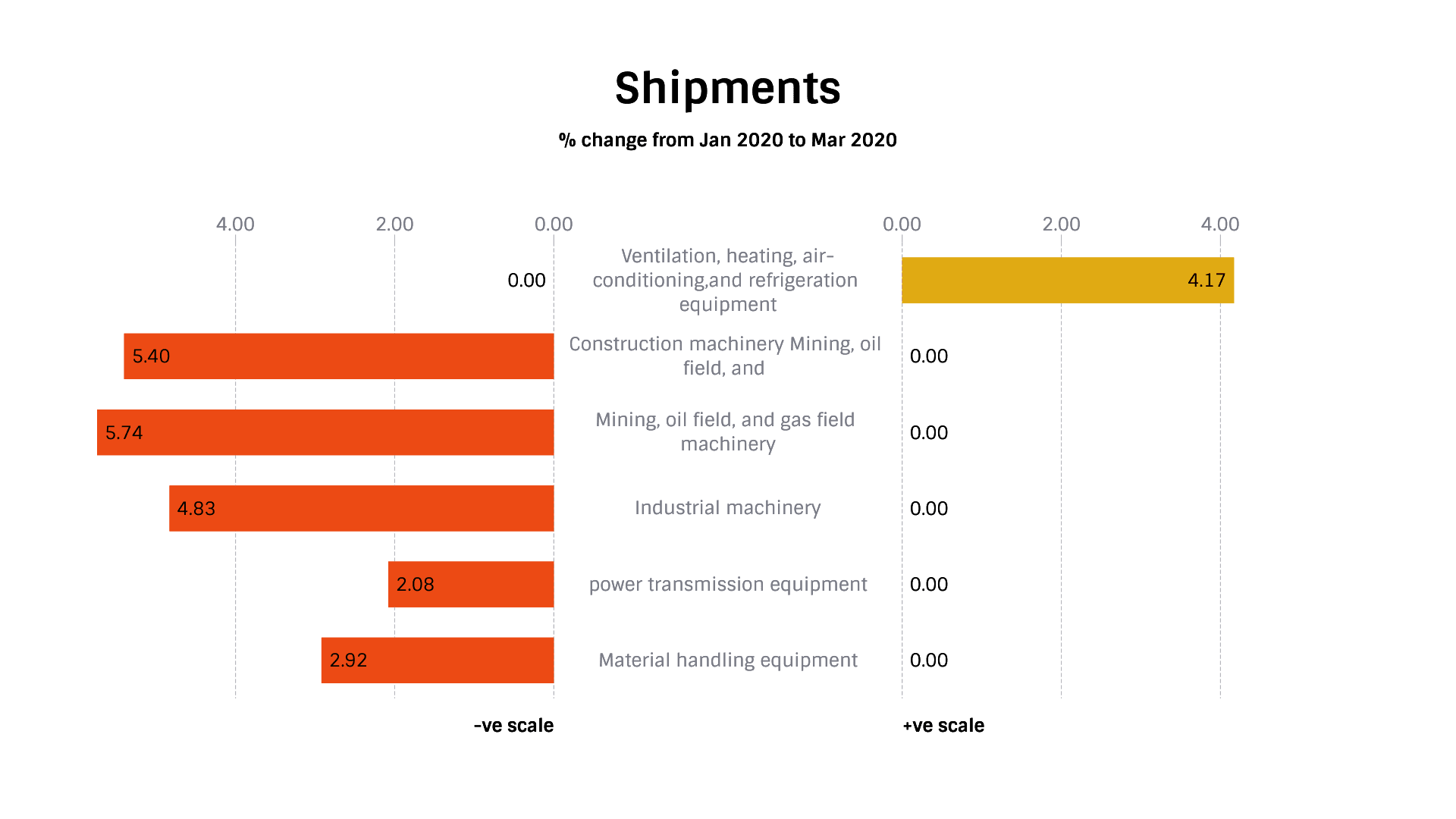

The total shipments across the Machinery group decreased by 2.15%. Also, the pandemic has had a noticeable effect on new purchases, as reflected in a decrease in new orders by 1.64%. The total inventory has increased by 0.72%. But on the flip side, the unfilled orders have reduced marginally by 0.13%, which may be a leading indicator of troubled times ahead.

The surprising industry to come out on top is HVAC Equipment, which has a new order backlog increase of 5.18%. The total shipments have also increased by 4.17%, indicating that the HVAC operations have remained close to normal.

What’s not surprising is that the Industrial Machinery sector has performed poorly. The total shipments and new orders backlog decreased significantly by 4.83% and 6.75%, respectively. There was also a 3.36% increase in inventory, and industrial machinery companies are better off planning for a reduction in excess inventory now rather than later.

The shocker in this data comes from the Construction Machinery sector, which seems to be the worst hit. There was a 5.40% decrease in overall shipments and a whopping 13.89% dip in the new orders during the first quarter. There was a marginal 0.84% increase in inventory. What also stood out was a major 9.95% decrease in unfilled orders due to lockdowns & non-functional customers.

Reference: https://www.census.gov/

Download White Paper